E-Invoicing using SAP Business One

E-Invoicing using SAP Business One

The transportation of goods from one place to another is facilitated by the filing of ‘E-Way Bills’ on the common GST portal. Similarly, the GST Council has decided to implement a system of e-invoicing.

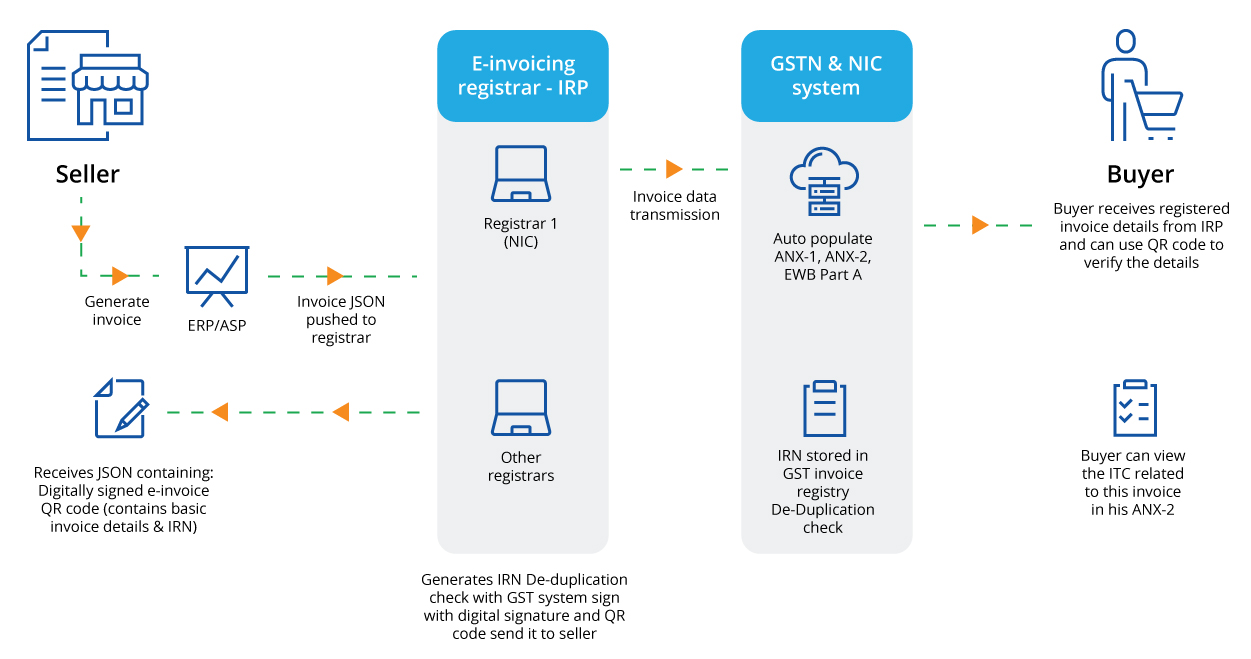

E-invoicing in SAP does not mean that the company must create its invoice using the government’s software system. Instead, it means that the company must submit information about their already generated invoice from their ERP system to the Invoice Registration Portal (IRP). On doing this, they receive the unique IRN (Invoice Reference Number) and a QR code from the portal, which needs to be printed/displayed on their invoice. The broad process flow of the E-invoicing system is displayed below.

Primarily, e-invoices must adhere to the GST invoicing rules. Apart from this, it should also accommodate the invoicing system or policies followed by each industry or sector in India. Certain information is mandatory whereas the rest of them are optional for businesses. Also, each e-invoice has to be registered individually and cannot be processed en masse.

Adhering to this system is made easy by SAP Business One. It offers two options for the actual solution deployment and usage to customers.

Options:

- File download

- Integration with GSP

File Download

In this option, SAP Business One will allow your user to download all relevant information in the format and type of file required by the government portals in ONE CLICK. In the case of E-invoicing, SAP Business One can generate the JSON file that can be uploaded to the IRP (Invoice Registration Portal).

Integration with GSP (GST Suvidha Providers)

In this option, your SAP Business One system will be integrated with the GSP’s software using the APIs for E-Invoicing. This automates the process and your user can directly print the sales invoice from within SAP itself, which would have the IRN and the QR code issued by the IRP. Customers can choose to work with any GSP. Praxis has developed an automated solution that can be used with any GSP.

Benefits of the E-invoicing System

1. Track Invoices in Real-time

With the help of e-invoicing, suppliers can track their invoices efficiently and in real time. It also allows the input tax credit to be available quickly for the supplier.

2. One-time Reporting of B2B Invoices

E-invoicing in SAP allows the taxpayer to report their invoices just one time. They can get it authenticated by the Invoice Registration Portal (IRP) which is responsible for validating invoices and issuing the Invoice Reference Number (IRN). The GSTR-1 will be auto-populated with the details once authentication is complete. This greatly reduces the time taken for the entire process to complete and reduces manual tasks as well.

3. Create E-way Bill Easily

E-way bills can be generated easily with the help of E-invoicing. Since most of the processes happen online, the taxpayer needs to update the vehicle details only and the Part-A of the e-way bill will be updated with the details automatically from the authenticated e-invoice.

4. Helps Buyers

Once the E-invoice is uploaded on the GST portal, it is shared with the buyer for authentication. The buyer can then reconcile the purchase order and accept or reject the invoice in real time.

Also Read: How to Optimize Purchase Planning and Control Costs with SAP Business One

5. Reduces Fraud

With real-time visibility of data shared with the tax authorities, the instances of fraud will be reduced as well.

6. Reduces Data Entry Errors:

E-invoicing in SAP ensures that invoices get uploaded on the common portal to facilitate multipurpose reporting. The portal auto-populates the details and ensures there is no need for manual data entry while filing GST returns.

7. Prevents Tax Evasion

With the help of real-time access, instances of data manipulation reduce to a great extent as invoices are generated before a transaction occurs. Tax officials have easy access to the output tax details and the input tax credit as well as making sure that only genuine ITC claims are filed.

8. QR Code

GST invoices are used to calculate the ITC amount. However, an assessee can misplace an invoice or want additional copies urgently. In such instances, the assessee can scan the QR code and generate invoices easily in a PDF format on the go.

Besides E-invoicing in SAP, Praxis has solutions available for taking care of your GST reports, returns, and e-way bills.

If you would like to know more about these solutions and find out how Praxis can help you in implementing enterprise applications such as SAP Business One, Zoho CRM, HRMS, and Payroll, please reach out to us at marketing@praxisinfosolutions.com